LEOSA for Federal Law Enforcement Officers, Explained

The Law Enforcement Officers Safety Act (LEOSA).

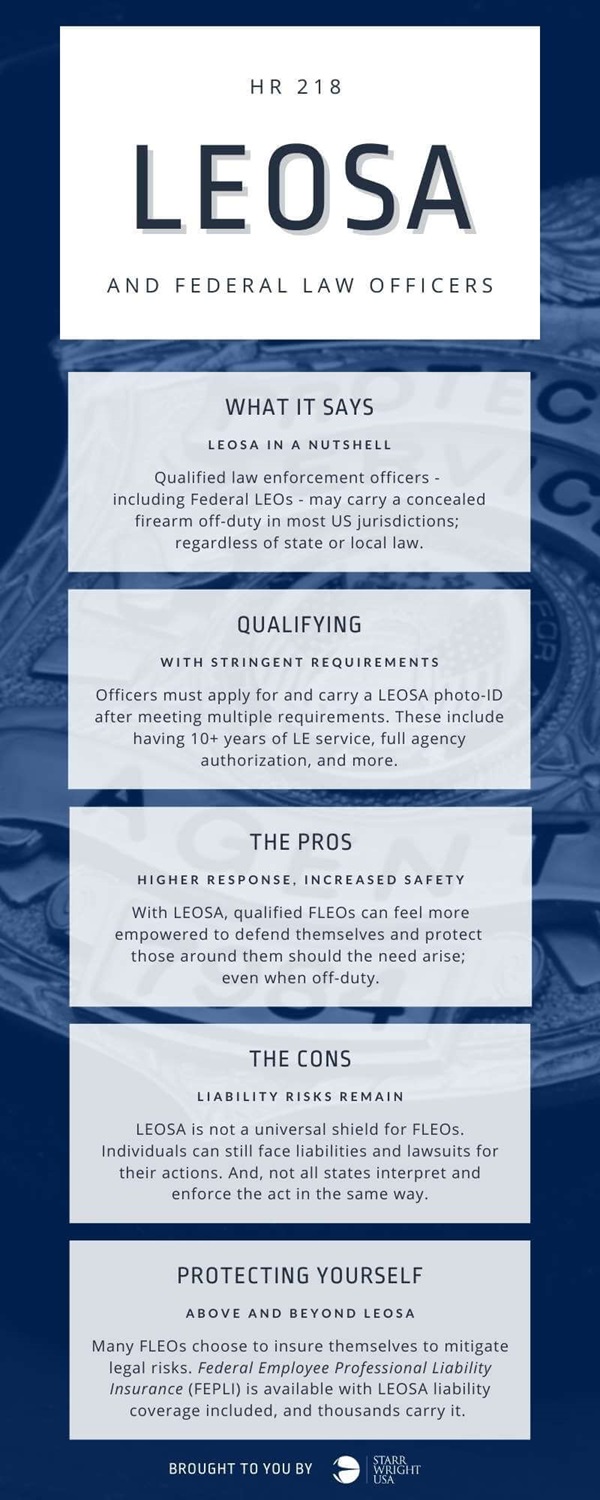

An important federal law, it allows Law Enforcement Officers (LEOs) of two classes expanded abilities to carry concealed weapons.

Enacted in 2004, the act was a large step in enabling individuals to defend themselves and others whenever necessary.

As the act is enmeshed with public safety and relates to a hot topic – firearms – it’s important to understand it. There are exceptions and gray areas to be aware of.

For Federal LEOs, an off-duty incident could be disastrous to your career. Even with LEOSA qualifications. Being aware of your rights, their limits, and options beyond LEOSA can make all the difference.

LEOSA in a nutshell

The Law Enforcement Officers Safety Act (LEOSA); also known as HR 218, begins as follows:

“Amends the Federal criminal code to authorize a qualified law enforcement officer carrying photographic governmental agency identification to carry a concealed firearm, notwithstanding any State or local law…” – Summary: H.R.218 – 108th Congress

The act allows LEOs to carry concealed firearms almost anywhere in the US and US territories. Qualified officers may do this regardless of state or local law (with some exceptions).

It applies to qualified law enforcement officers of two classes: active, and “retired or separated.”

As it should, the law is continuing to evolve. Since passing in 2004, Congress has amended the act twice. In both 2010 and 2013, reforms expanded and clarified LEOSA. And as of February 2021, a new LEOSA Reform Act is being considered in Congress.

Qualification requirements

To qualify, the active law enforcement officer must meet a list of criteria. They need full authorization from their agency to carry and use a firearm. They must have a total of 10 or more years of law enforcement service. And they may be under no disciplinary action, among certain other requirements.

The qualified officer must apply for and carry a LEOSA photographic identification card.

The benefits

LEOSA helps create consistency and security for law enforcement officers. In turn, it does the same for the civilians around them. According to Police1.com, “[LEOSA] was intended to improve response to threats in public..." Further, it allows "LEOs to protect themselves against criminals they may have had past dealings with.”

An officer with a valid LEOSA permit is not required to have a state-issued conceal carry permit. (Though some recommend carrying both, just in case.)

Law enforcement groups supported and celebrated the passing of LEOSA. Associations like Federal Law Enforcement Officers Association (FLEOA), believe it validates critical rights.

"LEOSA was enacted in 2004 as a clear federal right…to allow retired and former law enforcement officers to act as a force multiplier in our nation, especially when crimes, such as active shooters, seem to occur without notice and in benign situations." - Larry Cosme, President, Federal Law Enforcement Officers Association (FLEOA)

Exceptions to the Act

Even for qualified LEOs, LEOSA does have exceptions and exclusions. Some are explicit within the language of the law. Others are due to variance in state interpretations of it.

The term ‘firearm’ in this act is somewhat limited. It does not include any “machine gun, silencer, or destructive device.”

The act also does not supersede the rights of “private persons or entities" on their property. Any rule to "prohibit or restrict the possession of concealed firearms on their property,” stands. The same goes for “any state or local government property.” Some examples? School zones remain off-limits. So do government buildings such as your city hall or local post office. LEOSA also does not override businesses and other private property prohibiting concealed firearms.

| If you think of LEOSA as you’d think of an insurance policy, you might say that there are ‘gaps’ in your coverage.

Risks to qualified officers

LEOSA can allow a broader ability to carry out your sworn duty to protect and serve, even when off-duty. It can also offer a stronger sense of safety. Still, it does not shield you from all possible civil or criminal liability.

Even if you qualify, you must remain cautious, for your security.

If you think of LEOSA like insurance coverage, you would say that there are gaps in that coverage to be aware of.

Many factors could cause your LEOSA protection to be null. For example, if you enter private or government property, whether aware of it or not. There, any rules by the property owners about firearms take precedence. There is also the simple fact that not every state interprets and enforces LEOSA the same way. For example, New Jersey has stricter views on enforcement, as FLEOA summarized here.

Life can get in the way. Most won't always remember all the rules and regulations everywhere you travel. A slipup or forgetful moment could leave you exposed. And there is the fact that it's impossible to control the actions or allegations of other people.

LEOSA is there for the protection of qualified LEOs, yes. But with such an important public safety law, any mistakes could mean trouble.

Mitigating the risks

For federal law enforcement officers, there is enough to worry about every day. So, many FLEOs choose to mitigate their risks with specialized insurance. This insurance is Federal Employee Professional Liability Insurance (FEPLI). Specifically, an FEPLI policy that includes LEOSA liability coverage.

What is LEOSA liability coverage? It's insurance that can offer access to qualified legal defense for LEOSA-related acts.

The coverage comes in when your actions were legal and justified, yet;

- The situation still led to a liability exposure

- Someone is alleging your actions were criminal

- Your agency feels you acted out of scope, or beyond your authority

- You meet applicable coverage requirements

Some examples could include

- Arrest or lawsuit against you after discharging your weapon, despite valid reason and lack of resulting injuries or damage

- Causing bodily injury to someone while defending yourself by discharging your firearm

- Damaging public property while protecting a stranger from harm with your firearm

Please note, all claims must be evaluated based on their own merits and based on applicable facts and circumstances.

Coverage for FLEOs

There are some different options for FLEOs to consider when choosing their policy. Starr Wright USA is a top, trusted choice.

Starr Wright USA was the first insurance agency to ever offer FEPLI coverage. Upon opening in 1965, the agency committed to meeting the needs of federal law officers. Today, we remain focused wholly on serving federal employees.

Of Starr Wright USA’s FEPLI plan options, several include $500,000 of LEOSA liability protection. Unlike many companies, Starr Wright USA adds no extra cost for this important coverage, and it is as comprehensive as any policy on the market. Why? Because of our commitment to serving FLEOs. Starr Wright USA sees the importance of federal law enforcement to national security. We recognize the risks FLEOs face. To do our part, we strive to make the coverage affordable to all officers.

Learn more about FEPLI from Starr Wright USA by clicking here.

View the Law Enforcement Officers Safety Act in full at Congress.gov

Article authored by and containing the opinions of Starr Wright USA. This article is offered solely for informational purposes. Starr Wright USA is a marketing name for Starr Wright Insurance Agency, Inc. and its affiliate(s). Starr Wright USA is an insurance agency specializing in insurance solutions for federal employees and federal contractors. For more information, visit WrightUSA.com. Starr Wright USA is a division of Starr Insurance Companies, which is a marketing name for the operating insurance and travel assistance companies and subsidiaries of Starr International Company, Inc. and for the investment business of C.V. Starr & Co., Inc.